Splitting a corporation: a guide for businesses

Splitting a company can be a strategic choice when restructuring or to achieve specific business goals. Although the process may seem complex, it often offers important advantages, such as a clear structure or risk mitigation. In this article, we will discuss the two main forms of demerger, the steps in the process and some important points to consider.

What is legal demerger?

A legal split involves dividing a company into two or more independent entities. This can be useful, for example, when splitting off activities or setting up a more efficient business structure. The big advantage: no transfer tax is due in the case of a general demerger. This makes demergers financially attractive for many companies.

The legal basis for demergers is laid down in Article 2:334a of the Civil Code (“BW”) and onwards.

Benefits of a legal split

There may be several reasons why splitting a company can be a good idea:

No transfer tax: Assets are transferred by universal title, which avoids transfer tax.

More efficient operations: Activities are managed more conveniently.

Risk reduction: Risky activities can be separated from other business activities.

Flexibility in structure: The company can better respond to market developments or investment opportunities.

Two forms of demerger

There are two main forms of demerger: the pure demerger and the split-off.

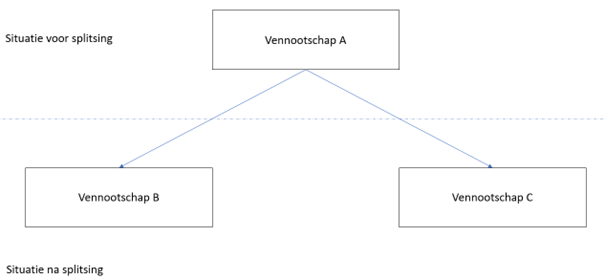

1. The pure demerger

In a pure demerger, the original company ceases to exist. All the assets are divided by universal title between two or more new or existing companies.

Important points to consider:

Licenses: Some permits are not transferable. Consider, for example, environmental permits or operating licenses. This may require additional procedures.

Intellectual property (IP): When splitting, patents, trademarks or copyrights must be carefully assigned. Misunderstandings about this can lead to legal complications.

Contracts: Check whether existing agreements contain clauses stipulating that they expire upon demerger. This can affect leases or long-term collaborations, for example.

Board positions: Board positions of the original company are not automatically assumed by the new companies. New directors must be formally appointed.

Thus, a pure demerger can look like this:

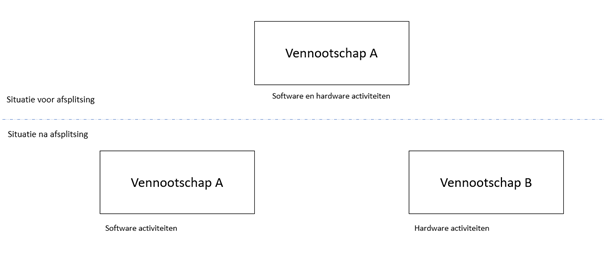

2. The split-off

In a demerger, the original company continues to exist, but transfers part of its assets by universal title to one or more other companies. This often occurs when hiving off specific activities.

A special form of demerger is the hybrid demerger, as described in article 2:334c paragraph 2 BW. Here the entire assets are transferred, while the original company retains all shares in the new entities. This form is useful, for example, when setting up a holding structure.

A split-off therefore looks as follows:

Splitting procedure

Splitting up a company proceeds through a number of steps laid down by law in Article 2:334f of the Civil Code and onwards.

(a) The demerger proposal:

(i) The board prepares a demerger proposal, which describes exactly which assets, including assets and liabilities, go to which company. This document must be prepared accurately to avoid later disputes.

(b) Approval:

(i) The supervisory board (if present) must approve the demerger proposal.

(c) Publication and opposition period:

(i) The demerger proposal is filed with the Trade Register and published in a nationally distributed newspaper. Creditors then have one month to object.

Conclusion

Splitting a company can offer great advantages, including risk mitigation, efficiency and financial benefits, such as avoiding transfer tax. However, the process does require careful planning, especially when assigning licenses, IP and contracts.

Our lawyers have extensive experience in legal demergers and will be happy to guide you through every step of this process. For tailored advice, please contact one of our attorneys via email, phone or the contact form for a free initial consultation. We will be happy to think along with you.