Payroll contracts

Payroll contracts introduced into law

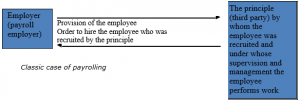

The distinction between the temporary employment contract and the payroll agreement is that the employer does not perform an allocation function with payrolling. In the case of payrolling, this means an employment contract in which the employee is made available to a third party by the employer, in the context of the exercise of the profession or business of this employer, pursuant to an assignment given by the third party to the employer, that has not been achieved in the context of bringing together supply and demand on the labor market, labor under the supervision and direction of the third party.

Rules for termination

Rules for termination that are now applicable to payrolling are adjusted in such a way that the payroll employee working at the principle receives the same protections and the same rights as the principle’s own employees. If a payroll employer wishes to dismiss an employee, this dismissal will be assessed on the basis of the reasons for terminating the contract of employment by the actual employer (the principle). If the reason is the reduction in the amount of work, the dismissal must be in accordance with the ‘reflection principle’ applied to the actual employer. The ‘reflection principle’ determines the order in which employees have to be let go in case of firing for corporate economic reasons. If there is insufficient ground for dismissal or if the employer does not act in accordance with the ‘reflection principle’, the UWV will not grant permission for dismissal and the employment contract cannot be terminated. The law will also demand equality for payroll employees in terms of pay, of pensions and of other benefits like childcare and other services available to the principles own employees. It will be mandatory for the principle to inform the payroll employee of the terms of employment. The main goal of the adjustments is to prevent the abuse of payrolling for cost related reasons.

call us

call us